Save Money on Taxes, Computer Hardware and IT Support

Dear Business Owner,

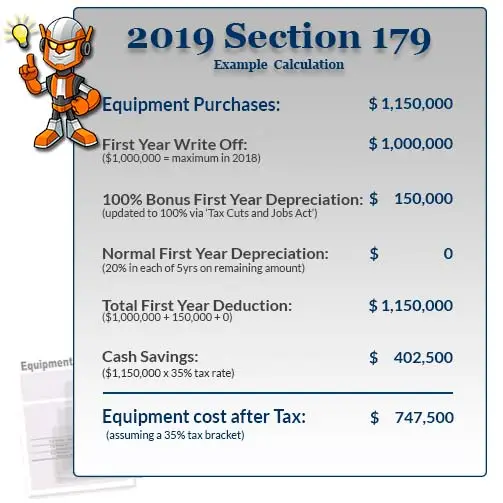

Thanks to a tax deduction titled a “Section 179 Election,” you can buy up to $100,000,000 with a “total equipment purchased for the year” threshold of $2,500,000, in new office and computer equipment, and expense or write off that entire amount on your 2019 tax return. However, the election must be made in the year of purchase in order to qualify for the deduction. This years deadline is December 31st, 2019.

But that’s Not the Only way You’ll Save Money… Manufacturers and Vendors are ALSO Giving Year-End Discounts, Rebates and Incentives…

But Here’s How I’m Going to “Sweeten The Pot” and Help You Save Even MORE Money…

In the spirit of saving money, I’ve decided to make the following offers to anyone who hires us to upgrade their network before December 31, 2019:

- We will give away ONE MONTH of our Guardian Service Plan — a $1,000 value – absolutely FREE to anyone who upgrades their network with us. All computer networks need regular ongoing maintenance to keep them running problem free, and with our Guardian Service Plan, you’ll not only enjoy faster and more reliable service from your computer network, but you’ll gain incredible peace of mind knowing that your network and the data it holds is safe from loss, corruption, downtime, viruses, hackers, spyware, and a host of other problems.

- After that one month, you can continue the Guardian Service Plan at a special discounted rate that will easily save you THOUSANDS in IT support. You can continue to receive regular maintenance, critical updates and security patches, fast remote support, and 24-7 watch over-your-network at a special discounted rate. (Of course, you are under no obligation to continue this maintenance, but I’m certain you are going to want to continue after you see how we keep things running.)

As a fellow entrepreneur, I understand it’s critical to keep every penny of profit that you can. After all, no one wants to hand over a penny more to the government than is necessary, and no one wants to pay MORE for services and products than they must. We all work way too hard for that!

This is Absolutely the BEST Way to Save a Lot of Money on IT Services and Support for 2019

But you Better Act NOW, 2020 will be here before you know it!...

All you have to do is contact us by phone or by faxing back the enclosed response form. We will call to schedule a day and time to discuss exactly what type of upgrades and support you will need for 2017. Remember, we don’t have to do the actual installation in December, but you must spend the money before December 31st or the IRS won’t give you the deduction!

Happy Holidays & Tax Savings,

Jeffrey Daniel

We are offering a FREE IT Assessment (a $1,500 value) to demonstrate our commitment to local business owners looking to improve their network security and compliance, backup and disaster recovery, and current IT / network challenges.